Pennsylvania is the only state that doesn’t regularly reassess its properties for tax purposes. A Pittsburgh state legislator wants to change that.

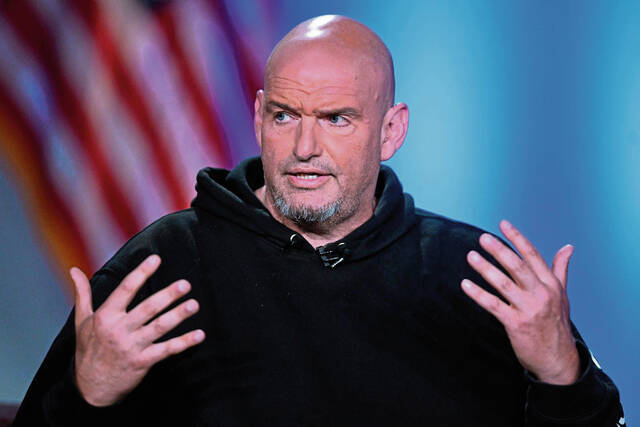

Sen. Wayne Fontana, D-Brookline, told TribLive that he is drafting legislation that would call for regular reassessments statewide.

“It is absolutely time to talk about this,” Fontana said Friday. “What are we waiting for?”

Fontana’s comments came after the Pittsburgh Public Schools board voted earlier this week to authorize a lawsuit against Allegheny County in an effort to force a countywide reassessment.

The board cited concerns that an ongoing decline in the value of large, commercial properties in Pittsburgh is causing a loss of property tax revenue and would lead to a dire budget crunch.

Abigail Gardner, spokeswoman for Allegheny County Executive Sara Innamorato, said the administration supports Fontana’s push for regular statewide reassessments.

She said Pennsylvania is now the only state lacking regular reassessments since Delaware passed a law last year to perform reassessments every five years.

“The state absolutely needs to be a part of the conversation about how we move towards a reassessment process that is regular and revenue neutral,” said Gardner. “Our counties, municipalities, school districts and homeowners deserve a better process.”

Other states have regularly scheduled reassessments. Ohio, for example, reassesses property statewide every three years.

Allegheny County’s last reassessment occurred in 2012, the result of a lawsuit.

Fontana said he hopes to introduce legislation in the fall and wants to hold public meetings before finalizing the language.

Pennsylvania counties independently decide when to reassess properties, but without doing so on a regular basis, many go decades avoiding the painful process.

Westmoreland County, for instance, hasn’t reassessed since 1972.

Commissioners there have long refused to consider a reassessment. Last fall, all three said they consider it a non-issue unless it is ordered by the courts.

Ted Kopas, Westmoreland County’s lone Democratic commissioner, said of Fontana’s plan, “There’s merit to the concept, but the devil’s in the details.”

He said that he appreciates the spirit of Fontana’s idea, but warned that counties would require major financial help from the state in order to implement a system involving regular reassessments, which would be expensive.

A lack of regular reassessments leads counties to rely on a formula called the common level ratio to determine the assessed value of property.

The ratio varies widely county to county.

Every year, taxing bodies (municipalities, school district and counties) and property owners appeal assessments on individual properties to determine tax payments.

Fontana said that this system leads to a “blame game” between municipal taxing bodies and county governments where municipalities and school districts are wary of raising local taxes, and county governments are hesitant to trigger reassessments out of fear that property owners will blame them for tax hikes.

“I am an elected official, I understand not wanting to look like you are raising taxes,” Fontana said. “Let’s end the blame game and just do assessments every scheduled time.”

Recent assessment challenges have led to massive drops in revenue for Pittsburgh’s school district.

The drop has been particularly stark in Downtown Pittsburgh, where skyscrapers have seen their values plummet by tens of millions of dollars after appeals.

“The severe Downtown property assessment reductions are a product of Pennsylvania’s broken reassessment system,” Fontana said. “The fact that we need a ‘common level ratio’ to calculate property values perfectly illustrates the dysfunction.”

Allegheny County Council President Pat Catena, D-Carnegie, said he welcomes the push for statewide reassessments and is grateful to Fontana for taking on the issue.

“It is frustrating that Allegheny County always gets singled out for this, and there needs to be some uniformity and consistency,” he said.

He said the state leading on this would give better guidance to counties on how to address what ends up being a politically fraught issue.

Fontana said a public process would help determine how often assessments should occur and whether counties or the state should complete them.

He said regular assessments would eliminate the need for a common level ratio.

They would also bring equity and end squabbling among taxing bodies, Fontana said.

When Fontana was on Allegheny County Council in 2003, he said he supported legislation for a reassessment every three years.

It never passed.

Fontana said he expects pushback in Harrisburg to his planned legislation and hopes that public meetings can build support before he introduces a bill.

“It is very unlikely to get many votes if brought up today, but the process is about building a case and informing lawmakers and the public,” he said.

Catena said he is pessimistic the state legislature will take up the cause since it hasn’t in the past.

“We will see if there is appetite,” he said. “We have been preaching this for a while, but the state hasn’t been that hungry to help.”

Fontana said Pennsylvania will likely see a lot of appeals and criticism of a first statewide reassessment, since some counties have not reassessed in decades.

But once the process is done regularly, he said, he expects headlines and controversy to evaporate.

Staff writer Rich Cholodofsky contributed to this report.